State tax issues for today and tomorrow paul buchman, johnson controls, inc. The business itself pays no corporate tax.

What Is A Disregarded Entity 7 Things You Need To Know About Single Llc Taxes - Anderson Business Advisors Asset Protection Tax Advisors

With the fast approaching state tax compliance deadlines, ptes and their owners are intensifying their attention on these taxes.

Flow through entity taxation. The principals can make a provision requiring that sufficient. Thus, the income is taxed only once. Also, what is a flow through entity example?

Eliminating c and s corporation penalty taxes by utilizing partnerships and other mechanisms. Utilizing partnerships and llcs to solve s corporation structuring limitations. The entity itself is not taxed and any business losses incurred or income earned is treated as the owner's personal income/loss.

Instead their owners include their allocated shares of profits in taxable income under the individual income tax, which is taxed as ordinary income up to the maximum 39.6 percent rate. Watch becker’s skills practice video to learn about reg: Structuring the admission of the service provider.

Sole proprietorships, partnerships (limited, general, and limited liability partnerships), llcs, and s corporations are all types of. This disconnect between receipt of “cash” and reporting of income can result in hardship from having to pay tax on money you did not get. Ptes and their owners should take these taxes into account when determining the impacts at the entity and owner levels.

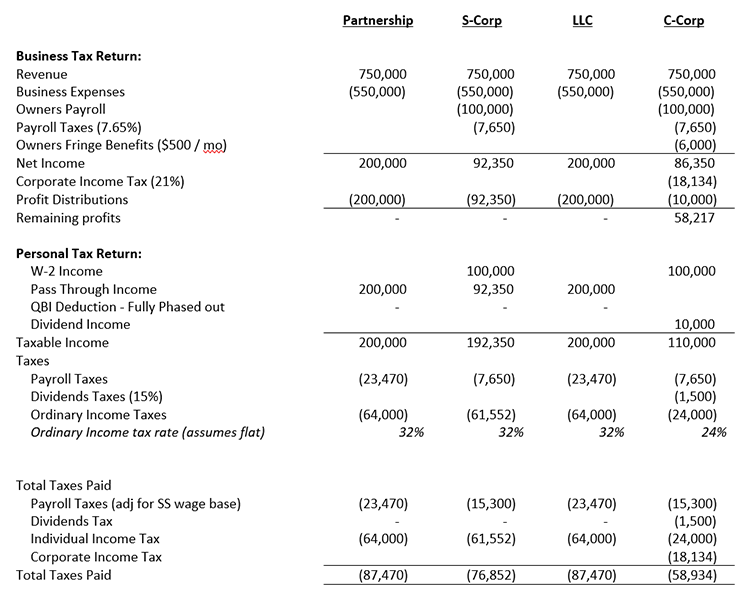

Income earned from a c corporation is taxed when earned and taxed when distributed to shareholders as dividends. By doing so, the income is taxed at the individual tax rate for any ordinary income which owners may receive. Because the income flows to owners or investors, the business is not taxed under the corporate income tax.

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act - Smith And Howard - Cpa

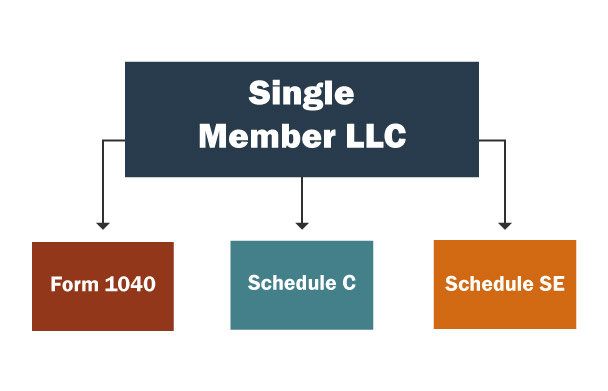

Llc Taxes - Single-member Llc Taxes

Hybrid Entities And Reverse Hybrid Entities - International Tax Blog

How To Choose Your Llc Tax Status

Pass Through Entity Definition Examples Advantages Disadvantages

How Should An Llc Fill Out A W-9 Form Correctly Ssn Vs Ein - W9manager

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act - Smith And Howard - Cpa

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

2

4 Types Of Businesses Business Basics Business Skills Business Person

2

Flow-through Entity - Overview Types Advantages

Converting From C To S Corp May Be Costlier Than You Think

2

How To Choose Your Llc Tax Status

2

What Is Double Taxation For C-corps The Exciting Secrets Of Pass-through Entities - Guidant

Pass-through Taxation What Small Business Owners Need To Know

Pin On Perky Perusal