You can find more information (including an estimated formula to calculate ytm) on the yield to maturity calculator page. This ratio expresses the percentage of money left over for shareholders compared to the price of the stock.

What Is Free Cash Flow Yield - Definition Meaning Example

Fcf yields > p/e multiples.

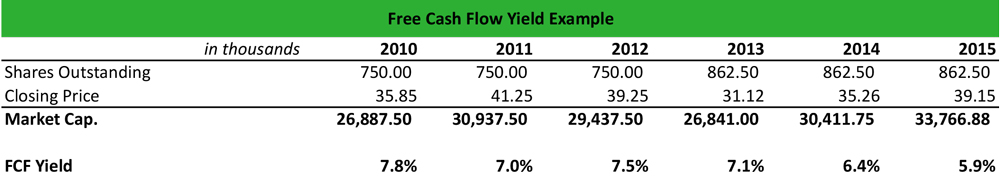

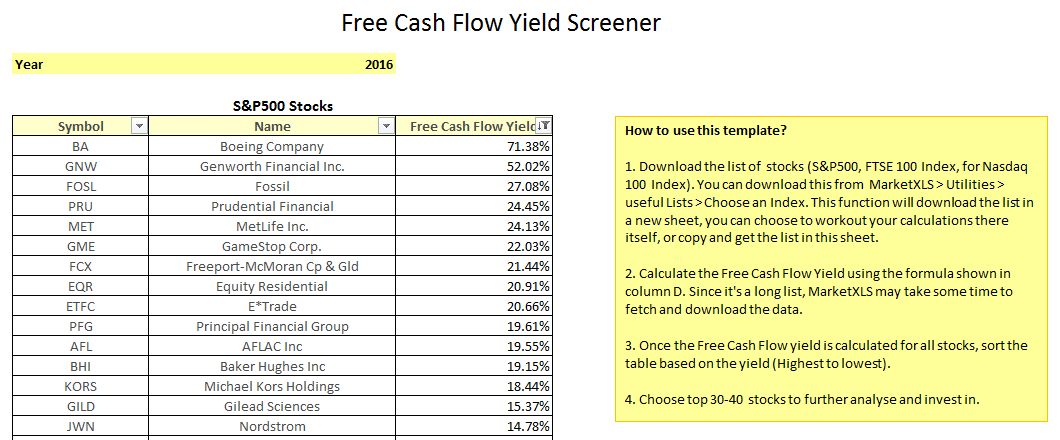

Free cash flow yield calculator. We can also compare the fcf yields to bond yields. At t+4 => normalized cash flow at t=0, and normalized yield. A higher free cash flow yield means that the company generates more cash with the same market valuation which is good for investors.

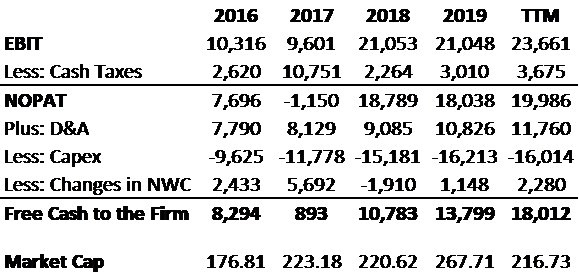

The ratio of free cash flow to a company’s enterprise value (fcf/ enterprise value ). Market capitalization is widely available, making it easy to determine. Free cash flow yield is really just the company’s free cash flow, divided by its market value.

(people sometimes describe this as free cash flow yield.) cash on cash yield is a different measurement often used to evaluate real estate investments. But previous year short term borrowings has be paid within next 12 months,that means before releasing current year balance sheet. Fcfy= free cash flow to firm (fcff) /enterprise value.

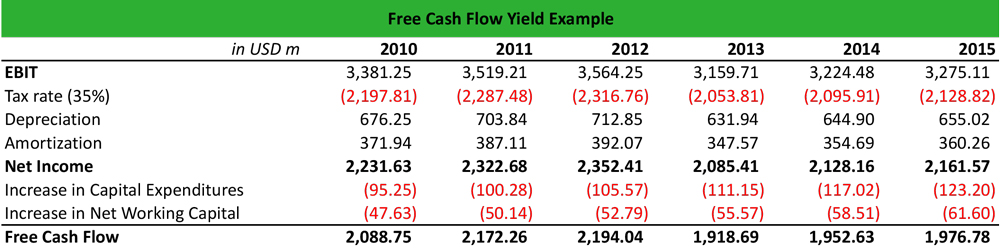

During the past 12 months, the average free cash flow per share growth rate of tesla was 26.10% per year. Sales at t=0 multiplied with margins etc. The formula is as follows:

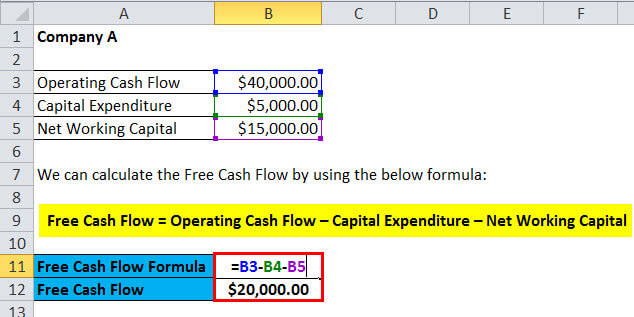

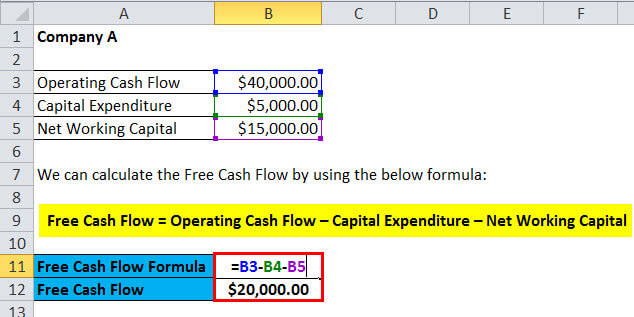

The free cash flow yield measures the amount of cash generated from the core operations of a company relative to its valuation. To break it down, free cash flow yield is determined, first, by using a company’s cash flow statement. Companies that can consistently generate free cash are those that have more opportunities to grow and reinvest back into the company, as well as give back to.

That's the ratio of free cash flow to market cap. If the ytm is less than the coupon rate, then the denominator of each cash flow will decrease, so the sum of those cash flows will be greater than the face value of the bond (and hence will sell at a premium). Free cash flow yield is an easy, simple metric to calculate and it can help us separate the wheat from the chaff by separating the companies that can consistently create free cash flow.

Looking back at the last five years, apple's free cash flow yield peaked in september 2017. Fcf yield is the answer: To calculate the terminal value for this method, use this formula:

Apple's latest twelve months free cash flow yield is 3.5%. The ratio is calculated by taking. The free cash flow yield is a value that indicates how much of the free cash flow generated per share by the company is contained in the current stock price.

Free cash flow yield evaluates if the stock price of a company provides good value for the free cash flow being generated. By comparing a company’s available free cash flow along with a profitability metric, the fcf conversion rate helps evaluate the quality of a company’s cash flow generation. For example, if you paid $100,000 for a.

Apple's free cash flow yield for fiscal years ending september 2017 to 2021 averaged 5.0%. In other words, this method would assume that your company will keep on generating continuous cash flow for an indefinite time. Its free cash flow per share for the trailing twelve months (ttm) ended in sep.

Cash flow statement a cash flow statement contains information on how much cash a company generated and used during a given period. Free cash flow yield calculation from a firm’s perspective (equity holders, preferred shareholders, and debt holders) is as follows: G refers to the perpetual growth rate of fcf

Just as before, keep buying as long as the normalized yield is higher than your rrr. Free cash flow is an important metric, but the level of fcf, by itself, does not provide. Then use the resulting free cash flow as your basis for a yield and share potential calculation.

In this video on free cash flow yield fcfy, we are going to discuss this topic in detail including its formula, calculation and examples.𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐫𝐞. Apple's operated at median free cash flow yield of 5.5% from fiscal years ending september 2017 to 2021. Free cash flow yield = free cash flow / enterprise value.

Free cash flow yield = free cash flow / market capitalization. Let’s take a look at an example below to understand how to calculate current yield as well as ytm. Fcff fcff (free cash flow to firm), or unleveled cash flow, is the cash remaining after depreciation, taxes, and other investment costs are paid.

Fcf refers to the free cash flow. When researching dividend stocks, usually, yields that are above 4% would be acceptable for further research. Cash may be king, but fcf yield is an ace.

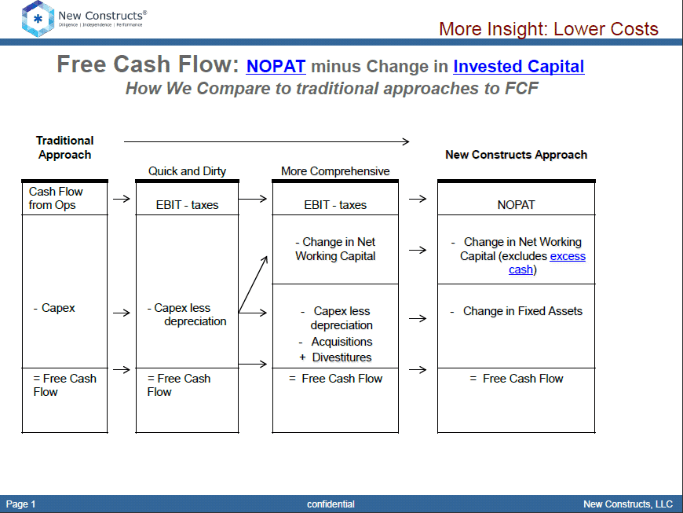

Based on whether an unlevered or levered cash flow metric is used, the free cash flow yield denotes how much cash flow that the represented investor group(s) are collectively entitled to. Tv refers to the terminal value. The free cash flow conversion rate is a liquidity ratio that measures a company’s ability to convert its operating profits into free cash flow (fcf) in a given period.

Free cash flow yield (fcfy) we can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis: The most common way to calculate free cash flow yield is to use market capitalization as the divisor. It is a good indicator to determine the investor’s payback period.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. In a sort of way, cash flow yield is like the earnings yield (reciprocal of price/earnings ratio ) because both compare profits to the stock price. Instead of market capitalization, it uses the price you paid for an investment as the denominator.

Free Cash Flow Meaning Examples What Is Fcf In Valuation

With This Ratio Cash Flows Are King Investinganswers

Free Cash Flow Yield - Finding Gushing Cash Flow For Future Growth

Free Cash Flow Formula Calculator Excel Template

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield - Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Formula Top Example Fcfy Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

What Is Free Cash Flow Yield - Definition Meaning Example

Free Cash Flow And Fcf Yield - New Constructs

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Explained

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow And Fcf Yield - New Constructs

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

Fast Free Cash Flow Yield Screener For Sp 500 Stocks Using Marketxls - Template Included